Chips under the wave of autonomous driving: ice and fire

Chips under the wave of autonomous driving: ice and fire

In recent years, the intelligent car industry can be said to be unlimited scenery, driving autonomous driving chips, lidar, 4D radar and so on all the way, but after entering 2022, especially since the second half of the year, the always hot market seems to have a noise.

"Ice and fire interwoven" autonomous driving chip

For smart cars, the autonomous driving chip is comparable to the "brain", is an important part of the autonomous driving decision-making layer, and also the hardware support to realize autonomous driving. In the process of automotive electronic and electrical architecture from distributed architecture to centralized architecture, autonomous driving chip as the carrier of computing has gradually become the core of the intelligent car era. At present, in this field, mainly by Qualcomm, Nvidia and Mobileye three world.

For Mobileye, I believe you are not unfamiliar, the recent sharp decline in the IPO valuation, it is once again on the top of the storm. According to Reuters, CNBC and other foreign media, Mobileye 2022 IPO filing on October 18 showed that the Mobileye was no more than $16 billion, when Intel announced plans to push Mobileye to list in the US in mid-2022, Reuters reported that the IPO could value Mobileye at more than $50 billion.

From $50 billion to $16 billion, Mobileye's valuation has fallen by two-thirds in less than a year, which is not good news for the entire self-driving chip business. Mobileye It used to be the dominant player in the global autonomous driving chip field. As early as 2007, it launched EeyeQ 1, the generation of autonomous driving chip *. At the end of 2016, it won more than 70% of the global market share of automotive safe driving system. In 2017, it was acquired by Intel for $15.3 billion, which created the The acquisition myth of Israel.

In fact, overall, the main reason for Mobileye's big valuation decline is the sluggish global economy. Us IPO offerings have been hit hard by rising inflation and interest rates, concerns about the U. S. economy and volatility, especially for tech companies like Mobileye. According to the Refinitiv survey, the U. S. technology IPO has raised about $507 million this year, the lowest since 2000, and several U. S. companies originally listed in 2022 have delayed their public offerings until next year.

Manhattan Venture Partners The managing partner Jared Carmel said: " The IPO market is dead, and to bring it back to life, you need a moment like Facebook (Facebook), Uber (Uber) or DraftKings to bring others back to the market. Most companies don't have the courage to lead the way when the market is so volatile."It's not clear if Mobileye will be the vanguard, but it's certain that despite the sharp valuation decline, Mobileye is expected to be one of the Wall Street's tech listings so far this year.

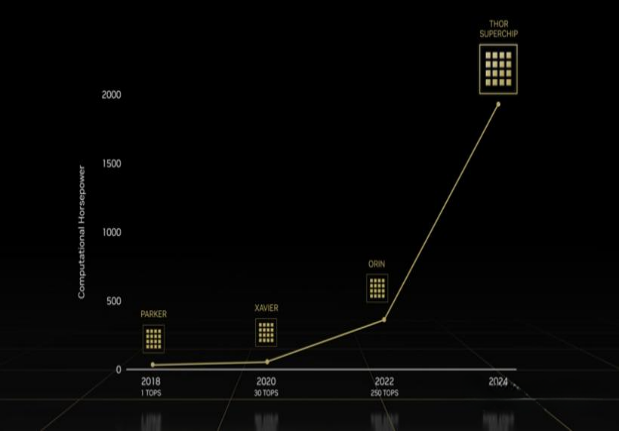

While Mobileye is in dire straits, Nvidia and Qualcomm on the other side are reaching new heights in computing power. At the end of September last year, Nvidia saw the launch of its latest generation of autonomous driving chip Thor chip, with a computing power of 2000 TOPS, nearly 8 times the current Orin, and is expected to launch in Geely's high-end electric car brand in 2025. In addition to its powerful computing power, Thor also integrates all the AI computing needs in the field of intelligent vehicles, including intelligent driving, active safety, intelligent cockpit, automatic parking, on-board operating system, infotainment, etc., and users can apply the huge computing power to different tasks according to their needs.

Photo source: Nvidia

Shortly after Nvidia launched the Thor chip, Qualcomm also launched the industry integrated supercomputer level car SoC Snapdragon Ride Flex, which can realize the comprehensive AI computing power of 2000 TOPS, and his goal is also consistent with Thor, that is to realize the central computing —— in the car, that is to provide computing support for intelligent driving, intelligent cockpit, communication and other capabilities.

Compared with Mobileye, both Nvidia and Qualcomm are underperformers in autonomous driving chips, but with their strong performance advantages, they have become the top leading companies in this field in just a few years. Although the earnings data show that only two smaller shares of the auto business, they are very optimistic about the outlook. Nvidia believes the auto business will be one of its future growth drivers and expects $11 billion or more in revenue in its auto business over the next six years. By the third quarter of this year, Qualcomm doubled the valuation in the past 10 months, with CFO Akash Palkhiwala announcing that the total potential market size of Qualcomm's automotive business would grow to $100 billion by 2030, with ADAS of about $59 billion / AD.

Of course, in addition to the above three autonomous driving chip design manufacturers, there is one major group is the car company self-research, the representative enterprise is naturally Tesla. Tesla's Full Self-Driving chips (FSD chips) were delivered on Model S & X and Model 3 as early as March and April 2019. As an autonomous driving product specifically for Tesla, FSD chip is not the most * autonomous driving chip, but it is undoubtedly the most suitable for Tesla. The FSD chip has been waiting for three years since 2019, and on a recent earnings call, Tesla CEO Elon Musk said he will focus more on the next FSD improvement, with FSD Beta 10.69.3 expected to be released this week.

And just recently, Great Wall Motor also confirmed that it will develop its own chip. On the evening of October 21, Great Wall Motor announced that it planned to use its own funds to jointly invest with Wei Jianjun and Wensheng Technology to set up Core Semiconductor Technology Co., Ltd. According to the Science and Technology Innovation Board Daily, industry insiders familiar with Great Wall Motor revealed that the field of self-developed chips involved IGBT, autonomous driving and intelligent cockpit.

Volkswagen on October 16, an official statement said, Volkswagen's software company CARIAD will be with local autopilot chip manufacturers horizon joint venture and holdings, Volkswagen group plans to the cooperation investment of about 2.4 billion euros, the deal is expected to be completed in the first half of 2023, according to 36 kr, former huawei intelligent driving Sue, head of wellknown will also join.

Although the traditional automotive chip suppliers are mainly concentrated in Europe, the United States and Japan, But in the intelligent driving phase, Local big-computing chip makers are also growing fast, The article shows that, As of the end of September of this year, Cambrian song, Black sesame Intelligence, Core technology, core technology, core intelligence, horizon, horizon, core technology 6 big computing power automotive chip manufacturers have completed 10 rounds of financing, Just recently, Another autonomous driving chip company, Yixing Intelligence, has completed more than 300 million yuan of financing, The favor of capital is good enough to prove the considerable market outlook, At present, domestic autonomous driving chips have won orders from many oems, such as Ideal, Hongqi, BYD, SAIC, and JAC.

"Hard up" in the cost of the lidar

The evaluation of lidar by car companies shows a strong polarization. On the one hand, Musk's extreme dislike of lidar, "fools use lidar", on the other hand, a large number of car companies increase the layout, focus on mass production and listing. Although tesla through 500000 annual sales, 1 million units user base experiment, proved that do not need laser radar, by image algorithm can basically realize wireless, but for other intelligent car companies, with laser radar high measurement resolution, long detection distance, large Angle, the advantages of the night work ability, part of fusion algorithm, and complete accurate annotation map is also one of the important way to realize automatic driving, and which, the most important is the cost of laser radar.

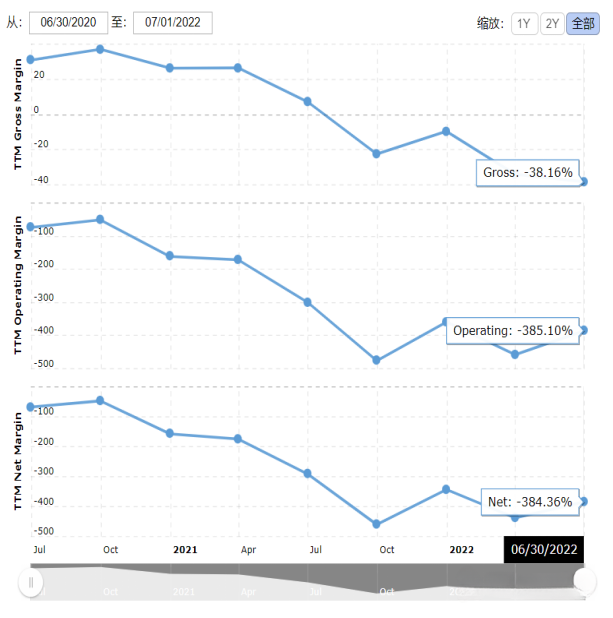

From the current overseas listed lidar companies, difficult to make profits is one of their pain points. At 30 June 2022, Velodyne was-384.36%; Ouster's total net loss for the second quarter was $28 million, down from $32 million in the first quarter; Aeva's revenue of $1.1 million for 2022, GAAP operating loss of $34.1 million;

June 30,2020-July 1,2022

Figure source: macrotrends

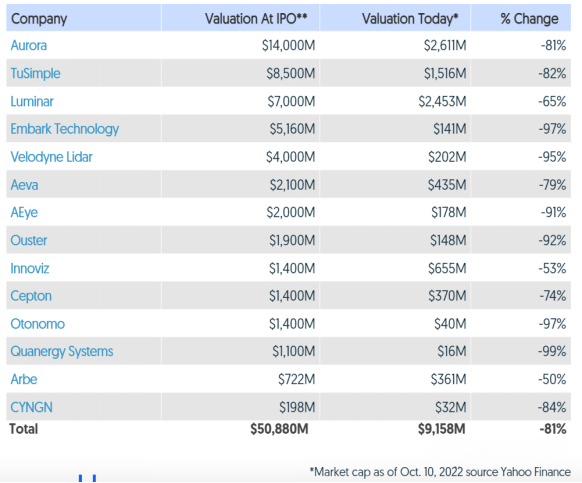

In addition, they also need to face a diving plunge in market value. In its market report, Crunchbase, which tracks the valuation and investment of start-ups, counted 14 companies related to autonomous driving technology, including Luminar, Velodyne Lidar, Aeva, AEye, Innoviz, Ouster, Cepton, Quanergy Systems, and so on. The market value of several lidar manufacturers can be described as brutal. Quanergy Systems Drop by 99%, Velodyne Lidar by 95%, Ouster by 92%, AEye also by 91%, compared with Innoviz, 53%, but compared with IPO, the market value has halved. It is understood that in order to reduce the risk of delisting, Quanery 2022 completed the reverse stock split, the valuation further fell.

Figure source: Crunchbase

Here, lidar listed companies are on the verge of delisting, and on the other side, Germany Ibeo, the founder of lidar, has filed for bankruptcy. On September 30,2022, German lidar company Ibeo Automotive Systems GmbH officially filed for bankruptcy, unable to obtain further financing, and the local court has approved its own bankruptcy proceedings.

Ibeo was founded in 1998, and has worked with Audi to create a global L3 level autonomous driving production vehicle. In 2021, Ibeo ranked fourth in the global lidar market. And it is such a big lidar veteran enterprise, fell in the eve of dawn, and the main reason for its bankruptcy is the lack of money, that is, the cost problem.

Cost has always been the disadvantage of lidar. Although Ibeo's main all-solid-state lidar technology route can meet the demand for miniaturization and easy integration in the long run, and is more likely to become the mainstream of lidar, the current technology is not mature and it is difficult to popularize it on a large scale. For lidar, mass production is one of the important factors in determining its cost, so the overall cost of the all-solid-state lidar technology route is still high.

And laser radar track on the international market in winter contrary, local laser radar market is still hot, Yole Intelligence recently released the 2022 automotive and industrial laser radar report shows that from 2018 to 2022, China's laser radar suppliers occupy 50% of the fixed share, large * in the United States, France, Germany, Japan, Israel and other laser radar enterprises in the region of the market.

Local manufacturers have targeted less expensive lidar, such as Huawei and Saiil Technology, which plan to launch in-board lidar that cost less than $200 and $100. At the same time, the volume of lidar assembly in the Chinese market is also rising rapidly. According to the data of Gaogong and Zsi, the assembly volume of 2021 / 2022H1 is about 0.8 / 24,700 units. From July last year, the intensive delivery of domestic new models will promote the assembly acceleration, and the annual assembly volume is expected to exceed 100,000 units. Under the optimistic assumption, the domestic passenger car lidar assembly volume is expected to impact 500,000 units in 2023.

Under the hot market, the local lidar manufacturers also ushered in a wave after a wave of financing heat. According to incomplete statistics, since this year, 14 lidar enterprises, including Sagittarius Juchuang, One Technology, Rum Intelligence, have completed a new round of financing. According to Yole, the market value of the lidar car industry will reach $2 billion by 2027, driven by Chinese "players" eager to integrate innovative lidar technology.

4D radar, to replace lidar?

In the Crunchbase form, Arbe, a 4D millimeter-wave radar manufacturer, changed the least, with a 50% drop. Theoretically speaking, 4D millimeter-wave radar adds the fourth index of "detection object height" on the basis of traditional 3D, which can classify static obstacles and not filter static obstacles, so as to avoid the safety risks caused by simple filtering of static signals.

Actually traditional millimeter wave radar is a very mature technology, there is no laser radar so hot, very important reason is the lack of height this dimension perception, there cannot high density point cloud imaging, cannot effectively resolve the target outline and category, low horizontal angular resolution, difficult to detect across the target and difficult to detect static target technical limitations. Tesla use millimeter wave radar, because millimeter wave is just an important and cheap sensor supplement, mainly rely on or image algorithm, even so, tesla still happened because of millimeter wave radar misjudgment of traffic accidents, such as the car accident happened in 2016, is because the millimeter wave radar as a backup sensor, did not identify obstacles ahead and early warning.

Image algorithm powerful such as tesla, the rest of the car makers rely on millimeter wave radar obviously more unlikely to achieve the ideal autopilot, but the emergence of 4D radar broke the millimeter wave radar car embarrassing period, forward 4D radar system can determine the object in distance, azimuth, elevation and relative speed position, provide more detailed information, also can provide more real path planning, accessible space detection function. Even in various bad weather and environmental conditions, 4D radar can also judge the movement time and speed of the vehicle. In this respect, it has more advantages than cameras and lidar, and is more in line with the safety requirements of autonomous vehicles. Because cameras can be damaged in strong sunlight and can have depth and contrast problems, lidar is relatively less adaptable to bad weather such as rain, snow and fog.

In addition, another obvious advantage of 4D radar is the cost. The price of 4D imaging millimeter wave radar is between $100 and $150, only one tenth of that of lidar. In the short and medium term, the mass production cost of 4 D radar is much lower than that of lidar. Based on these advantages, 4D radar has the potential to replace lidar, Mobileye CEO Amnon Shashua told 4D imaging millimeter-wave radar in this year's CES speech, " By 2025, except for the front, we only want millimeter-wave radar, not lidar.”

Although there are no cost concerns, the 4D radar faces technical challenges. Traditional radar system usually has three transmitter / 4 receiver antenna architecture, but 4D radar antenna channel is much more than the traditional system, such as NXP imaging radar chipset solution adopts the flagship S32R45 radar MPU and the second generation of high performance RFCMOS radar transceiver TEF82XX, used for 12 launch and 16 receive 77 GHz antenna channel, although improve the performance, but let the transceiver volume several times larger. Therefore, how to put down so many transceiver antennas in a relatively small packaging volume has become a technical difficulty of 4D radar.

Write at the end

Although the current overseas listed companies related to autonomous driving technology are facing the risk of valuation collapse, there is no doubt that autonomous driving will become the future development trend. Who will let many autonomous driving chip manufacturers take the lead in the future intelligent driving industry? How will lidar and 4D radar compete? These questions are currently impossible to answer, but the good news is that local manufacturers seem to be ready for the computing power, cost and other challenges in the future.