Qualcomm MediaTek, crazy car chip

Qualcomm MediaTek, crazy car chip

On May 30, Jerry Yu, senior vice president and general manager of Mediatek's CCM division, revealed that the company's 3nm automotive chip will be released in 2024 and mass production in 2025.

The explosion in demand for automotive chips over the past few years has given these big companies room to grow. By contrast, the decline in the mobile phone market continues, far less than the imagination of automotive chips. The decline in revenue from the mobile phone business is also the main reason for Mediatek to move to cars.

However, mediatek's crossover journey will not be smooth. Before this, Qualcomm, Nvidia and other semiconductor giants have already entered the bureau, and have made certain achievements. The demand for automotive chips is very large, the market prospect is very broad, but the competition is also very fierce, some of these big factories choose to alliance to strengthen their strength, some foster strengths and circumvent weaknesses hope to build competitive barriers by technology, who will not accept who.

Mediatek high school transferred to the bureau, blowing a new war horn. This time, who can successfully through the siege?

Mediatek " got on the car to find a new outlet

After a few years of success, the semiconductor industry took a sharp turn for the worse. Except for Nvidia, which is on the AI model, the other giants are under a lot of pressure. Mediatek's announcement of automotive chips is also directly related to the continued decline in the mobile phone market.

The Value Institute (ID: jiazhiyanjiusuo) said in the previous report "45 million phones were sold in the first quarter, Apple and Samsung could not survive" that global smartphone shipments are still declining in the first quarter of this year, and the data given by major institutions are quite pessimistic.

Among them, Counterpoint reported that global mobile phone shipments were only 280.2 million units in the first quarter, down 14% year-on-year and 7% respectively from the previous quarter. In terms of regional distribution, not only China and the United States, two major mobile phone consumers, saw weak growth. The shipments of Europe also fell to the level since the second quarter of 2012, while the shipments of the five Southeast Asia countries fell 13% year on year.

From the brand point of view, the top two Samsung, Apple situation is not ideal, but at least to retain a trace of face. The former returned to the top spot with 22% in Europe, the Middle East and Latin America, while the latter saw the positive growth of the top five, at a dismal 3% increase.

However, the help of Samsung and Apple in diaTek is limited. As we all know, Apple has been strengthening its chip self-supply capacity, except for Qualcomm, which supplies 5G baseband chips, no one can hold Apple's neck. Samsung's own chip, the Exynos, is not popular, but most of its high-end models use Qualcomm Snapdragon chips, and it was not announced until the second quarter of last year that MediaTek entered Samsung's high-end product line for the first time.

Mediatek's main customers are actually Chinese mobile phone manufacturers such as Xiaomi, OPPO and vivo, and the entry-level products are the main sales force. But shipments from the three companies fell 22%, 8% and 17% respectively in the first quarter, also collapsing mediatek's results.

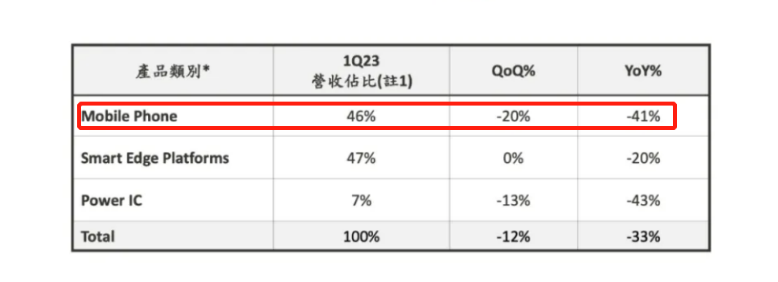

Mediatek's total revenue in April was NT $28.35 billion, down 46.13 percent and 34.01% respectively from a year earlier, much higher than 33 percent and 11.6% in the first quarter. First-quarter earnings breakdown showed that smartphone chip revenue plunged 41%, far more than another main business, smart edge platform.

(Photo from MediaTek Financial Report)

Mediatek itself has no idea about its performance in the coming quarters, and is in a more disadvantaged position than its old rival Qualcomm. Mediatek's gross margin fell 2.3% to 48% year on year, down from Qualcomm's 55.22%. In terms of revenue, Qualcomm's year-on-year decline was 12%, also significantly lower than Mediatek.

Since the end of last year, Qualcomm has repeatedly spread the news of price reduction and inventory clearance, focusing on the promotion of low-end SoC, directly aimed at Mediatek. The downward trend of smartphone demand shows no sign of ending in a short time. MediaTek, which is mainly entry-level products with low gross margin, is unable to participate in the price war, and can only be constrained by Qualcomm everywhere.

In the face of this adverse situation, another way out to enter the car chip track is normal.But mediatek wants to get on the bus smoothly, it is not so simple.

How good does Mediatek win again?

Although the launch and mass production schedule has been set, there is still a lack of information on the performance and research direction of Mediatek's automotive chips in the market, and its research and development strength is still a mystery. In the automotive world, mediatek's biggest ace is the Dimensity Auto automotive platform, which was released on April 17.

According to the official introduction, the Dimensity Auto platform includes four solutions: cockpit platform, connection platform, driving platform and key components. Most closely related to the chip business is the key component platform, which focuses on power management chips, screen driver chips, camera ISPs and other products, with the goal to become a core supplier of the new generation of smart car chipsets.

Several other solutions businesses, with different priorities, also have more or less something to do with chips. The introduction of the cockpit platform and the driving platform all mentioned the keywords such as high computing power AI processor and APU AI unit, not without the support of the chip.

But the Dimensity Auto platform has just been released, and its strength remains to be proven. As a latecomer in the auto industry, the most immediate way for Mediatek to quickly gain a firm foothold is to find a strong partner, ——, such as Nvidia.

On May 29, Mediatek announced a cooperation with Nvidia to develop a vehicle SoC integrating GPU core. Nvidia will provide AI, graphics computing IP and other technical support, while its GPU core can provide interconnection technology to realize high-speed circulation of core particles. Both sides are very satisfied with this cooperation. CAI Lixing, vice chairman and CEO of Mediatek, said that Nvidia's ADAS solution will further strengthen the AI capabilities of Mediatek's Dimensity Auto platform.

Nvidia moved into the automotive chip market earlier than Mediatech, having previously focused on self-driving chips. Its iconic product, Orin x AI chip, once surpassed Tesla, and was adopted by many car companies such as Nio and Ideal. Thor, a new generation of autonomous driving chips released in September, has significantly increased its computing power, mainly for the high-end market.

In addition, Nvidia also has a system-level chip NVIDIA DRIVE Orin™ SoC, a centralized in-car computing platform, and a DRIVE Hyperion developer suite. As a veteran player in the automotive chip industry, Nvidia has rich technology reserves and a stable market share. Now pull diaTek for research and development, in Huang's words, is to combine the advantages of both sides, strengthen the software strength.

With Nvidia's support, Mediatek is certainly great. But mediatek's challenge is not only its own technology, but also its powerful rival ——, especially Qualcomm, the old enemy.

As early as 2016, Qualcomm's second-generation smart cockpit chip, the Snapdragon 820A, entered the supply chain of large car companies such as Honda, Audi, Xiaopeng, Ideal and Ford. The 7nm technology Snapdragon 8155 chip launched in 2019 is the ceiling of computing power, almost monopolizing the high-end market and establishing Qualcomm's dominant position.

The auto business has also been one of the few bright spots in its dismal recent quarters. In the second quarter of fiscal 2023 (natural first quarter of 2023), Qualcomm's auto chip business revenue was $447 million, up 20% year on year. Although there is still a big gap between revenue ratio and mobile phone business, but the growth momentum deserves recognition.

The cockpit chips are part of Qualcomm's leverage in the automotive chip market, but not its full ambition. In the last two years, as the throne of smart cockpit chips becomes more stable, Qualcomm has also begun to expand its tentacles into other fields, including autonomous driving SoC and autonomous driving design platform.

At a recent public investor event, Qualcomm executives said that automotive chips will play a more important role in the entire semiconductor industry over the next 10 years. In order to build this second growth line, Qualcomm will increase investment and layout more products and technologies.

In general, Qualcomm's automotive chip road started earlier than Mediatek, and the results are more affordable. In the face of the old opponent's provocation, Qualcomm heart will not be too panic.—— From the perspective of the cooperation plan announced by Mediatek and Nvidia, the two sides will fully enter the fields of intelligent cockpit chip, vehicle gauge SoC and so on, which is equivalent to directly entering the hinterland of Qualcomm.

In the short term, mediatek is also difficult to bring substantial impact to Qualcomm. But in the long run, the friction between the two sides will certainly intensify and lead to a new round of technical roll.

Can the automotive chip technology usher in a breakthrough?

The advantage of the automotive chip track is its broad prospects and sufficient demand. Compared with traditional fuel vehicles, new energy vehicles focusing on intelligence have higher chip requirements, and many car company executives have complained of chip shortages in the past few years.

In new energy vehicles in the Chinese market, for example, China electric steam car hundred will vice President of Mr Zhang held at the end of last year "global smart car industry summit" forecast, by 2030, China's automotive chip demand will reach 100 billion-120 billion / year, chip in high-end smart car material cost proportion will rise to 20%.

"By 2030, China's auto chip market will be worth about $30 billion, with growing demand and a growing gap.”

Qualcomm has also said that the Internet of vehicles chip, intelligent cockpit chip and intelligent driving chip are the three branches of automotive chips with the highest proportion of demand and cost, and there is still a lot of room for growth in the next few years. Ambition and technical ability of the chip manufacturers, will not let go of these several "gold mines". Qualcomm itself is quite active, constantly acquiring related enterprises, to enrich the technical reserves.

In early May, Qualcomm subsidiary Qualcomm Technologies announced an acquisition agreement with Israeli chip maker Autotalks, which was founded in 2008 and focuses on the development of vehicle communications systems and the development and production of short-distance communications chipsets. Before being acquired by Qualcomm, Autotalks had entered the supply chain of a number of auto companies and semiconductor manufacturers, including Toyota, GENERAL Motors and Bosch, etc. It is a low-key but powerful high-quality enterprise in the industry.

After winning the Autotalks, Qualcomm's plan is also very clear: the former technology and products into its Snapdragon Digital Chassis system, to strengthen the technical shortcomings. This approach is the same as the acquisition of Imsys Technologies, Flarion Technologies to obtain wireless communication chips, video processing chip core technology, is the old way of Qualcomm.

In fact, Qualcomm's approach, it can also inspire mediatek and other competitors: technology is productivity, and consolidating the original strengths is as important as strengthening the weaknesses. Buying external companies is a shortcut to expand the technology reserves in a short period of time, after all, automotive chips are too wide, no manufacturer can master all the technology on its own.

After expanding their technology reserves, the next question they should think about is how to achieve technological breakthroughs.

In the era of intelligent cars, car standard level chips mainly include four categories. Among them, the most basic is MCU microcontrol chip and memory, the industry leaders are NXP, Infineon, STMicroelectronics and other old players, it is difficult for other manufacturers to squeeze into the circle; the demand for power semiconductor and sensor chips is relatively stable and low profit, Qualcomm, Mediatek and other giants are focused on the master chip, especially intelligent cockpit, autonomous driving SoC.

At present, the mainstream of the automobile industry is the pursuit of intelligence, which puts forward higher requirements for the computing power of the chip, and is very different from the MCU, which mainly pursues safety. Improving the chip computing power, the pursuit of advanced manufacturing process, is the direction of chip manufacturers.

In recent years, Qualcomm and Nvidia have been doing AI chip computing power. As soon as Nvidia released Thor in September last year, Qualcomm began to promote the "industry integrated car supercomputer SoC" Snapdragon Ride Flex, which claims to integrate 2000 TOPS to the end.

Now that Qualcomm continues to buy new companies, and Nvidia and Mediatek are forming an alliance, the investment is certainly modest. In the next few years, the computing power of the car master chip, I believe it will usher in more climax.

04 is written at the end

Of course, not only Qualcomm, Mediatek.

On May 10, Musk met with Samsung Executive Chairman Lee Jae-yong at the California Semiconductor Research Center, according to Yonhap news agency, the main topic of the meeting was cooperation on self-driving chips. Samsung has previously proposed to become a global * automotive semiconductor company by 2025. Tesla has also been exploring its own chip business, trying to strengthen its control over core components, and the two sides agree what they need.

Mediatek is not early and its rivals are strong, so it is not easy to gain a foothold on the competitive automotive chip track. In the end, technology is also the most reliable shield for a semiconductor company.As a latecomer, Mediatek does not have to have too many distractions, and wholeheartedly improving technology is the first task.