What is a silicon wafer and its development history

semiconductor industry : silicon wafers

Semiconductor materials are the substrate for chip production. There are many materials for making production. At present, semiconductor materials mainly coexist with silicon base and compound materials. Common semiconductor materials are silicon, gallium arsenide, gallium nitride, and silicon carbide. With the development of science and technology, silicon material gradually tends to the physical limit in semiconductor production, so it cannot meet some harsh conditions of high power, high frequency and high pressure. At present, compound materials can be made into single wafers with silicon materials based on silicon materials, which can also meet the requirements of radio frequency chips and power devices for high frequency, high pressure and high power, which alleviates the disadvantages of silicon materials to a certain extent.

Compared with other semiconductor materials, silicon materials have a larger application field and demand. Silicon semiconductor is mainly used in logic devices, memory and discrete devices. Compound semiconductors, such as gallium arsenide, gallium nitride and indium phosphide, are mainly used in optoelectronics, radio frequency, power and other devices with high frequency, high pressure, high power characteristics. In the current application of electronic products, the demand for compound materials is far lower than silicon materials, only a small number of military, security, aerospace and other ultra-high specification applications, only need to use compound single crystal materials.

Even though the semiconductor materials have developed to the third generation: silicon carbide, gallium nitride and diamond, but the mainstream is still mainly silicon materials, more than 90% of the semiconductor products are made of silicon elements. Mainly because the silicon element has the following advantages: 1) safe and non-toxic, harmless to the environment, belongs to the clean energy.2) Natural insulator can form silicon dioxide insulation layer through heating to prevent semiconductor leakage phenomenon. Therefore, subtract the step of depositing multi-layer insulator from the surface of wafer manufacturing to reduce the production cost of wafer manufacturing.3) Rich in reserves, silicon accounts for 27.7% of the earth's crust, reducing the material cost of semiconductors.4) The production process is mature. The development of semiconductor silicon wafer technology made from silicon material has improved from 2 inch silicon wafer in 1970 to 18 inch silicon wafer in 2020. After a long period of development, compared with other semiconductor materials, the application technology of silicon materials is more mature and more efficient in scale. Under such conditions, silicon materials appear "good quality and cheap", which gives silicon materials an irreplaceable position in the industry.

Semiconductor industry industry chain

Semiconductor silicon wafer is the upstream of the semiconductor industry chain and the core material for chip production, which runs through the whole process of chip production. The quality and quantity of semiconductor silicon wafer are not only the key material for chip manufacturing, but also restrict the development of the downstream terminal industry.

In the silicon wafer industry chain, the upstream is the raw material silicon ore, the midstream is the silicon wafer manufacturer, with strong bargaining power, and the downstream is the chip manufacturer. Upstream silicon ore is rich in raw materials and has weak bargaining power. In contrast, silicon wafer manufacturers in the process of silicon wafer production, need precision machinery and equipment, mature process and excellent technical personnel to do the support, to produce qualified quality silicon wafer, so the machine, process and technical personnel master is crucial. Only silicon wafer manufacturers that meet these conditions will have the ability to provide downstream chip manufacturers with qualified silicon wafers. At the same time, silicon wafers have to be certified by downstream chip manufacturers before orders can take place. Therefore, the silicon wafer manufacturers that meet the customer certification and have a higher technology process, the weaker the substitutability, and have a strong bargaining power.

In the semiconductor industry chain, the upstream mainly includes chip manufacturing raw materials and key chip manufacturing equipment, such as lithography machines, etching machines, thin film deposition equipment, the midstream is chip manufacturers, and the downstream respectively corresponds to the application manufacturers in the terminal field, such as smartphones, AI and IOT. Upstream wafer raw materials and key equipment have strong bargaining power, mainly because the manufacturing of wafer raw materials and key equipment has high technical barriers and weak substitutability. Midstream chip manufacturing is mainly: IC design, IC manufacturing and IC sealing and testing. IC designers design chips according to customer requirements; IC manufacturers mainly etch IC designers to semiconductor wafers; IC sealing test is mainly to package and test chips. At present, midstream manufacturers are divided into three modes: IDM (integrated), Fabless (IC design and sales) and Foundry (IC Manufacturing and sealed testing). IC design has the highest profit, but IC manufacturing has strong bargaining power, mainly because the front manufacturing and back sealing and testing of IC manufacturing also have high technical barriers. Therefore, for downstream terminal application manufacturers, IC manufacturers and IC sealing and testing manufacturers have low substitutability and strong bargaining power.

The most downstream terminal application fields in the semiconductor industry mainly revolve around: 5G communication, IOT, smartphone, automobile and AI, etc. The development of these fields has driven the demand for semiconductor silicon wafers. Through the previous analysis, the foundation of semiconductor silicon chip chip manufacturing, and the chip is an indispensable electronic component for terminal applications, so the technical innovation of these downstream terminal applications has driven the increase of the demand for midstream chips, thus promoting the increase of the demand for silicon chips. While the development of downstream terminals depends on the supply of upstream silicon wafers, only qualified silicon wafers can lay a solid foundation for the production of chips and provide good chips for the downstream terminals.

The purity, surface flatness, cleanliness and impurity pollution degree of the semiconductor silicon wafer have an extremely important influence on the chip, so the manufacturing of the semiconductor silicon wafer is very important. Semiconductor silicon wafer manufacturing can be mainly divided into the following steps:

Crystal growth: in order to achieve the flatness and uniformity of the integrated circuit on the silicon wafer, the single crystal furnace can first heat the polysilicon raw material at high temperature, and then adjust the speed, temperature and pressure parameters, pull up the cylindrical silicon rod;

Whole type: after obtaining the silicon crystal rod, it is treated completely. First of all, remove both ends of the silicon rod, check the resistance to determine the whole silicon rod to achieve the appropriate impurity uniformity, and then the silicon rod radial grinding, to obtain the diameter of a certain size of the silicon rod;

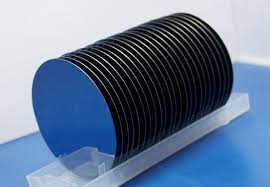

Slice: slice the whole silicon crystal rod with a slicing machine to obtain the silicon wafer of the target thickness;

Woredge and chamfer: mechanically grind both sides of the wafer to remove the damage left by the slice and make the wafer flat and highly parallel. Then the edge of the silicon wafer is polished and trimmed to remove the cracks or cracks of the edge, so that the edge of the silicon wafer is fully smooth;

Etching: corrode and etch the surface of the silicon wafer by chemical solution, remove the damage layer and stained layer on the surface of the silicon wafer after cutting and grinding, improve the surface quality and improve the surface smoothness;

Cleaning: after cleaning the particles and impurities on the surface of the wafer after the above process, the wafer should reach the degree of almost no particles and pollution;

CMP polishing: the CMP technology is used to polish both sides of the silicon wafer, so that the surface of the silicon wafer is smooth and smooth;

Measurement: test whether the surface particles and wafer size of the silicon wafer meet the customer's production quality standard.

In the manufacturing process of silicon wafer, technicians, manufacturing equipment and process flow are the key factors. The technicians are skilled in the operation and monitoring of the equipment, the precision of the silicon wafer specifications, the maturity of the process, and affect the excellent degree of the silicon wafer production. Among them, the key machinery and equipment are single crystal furnace, CMP polishing machine and measuring equipment. In order to change the conductivity of silicon, the polysilicon is processed by single crystal furnace to change the conductivity and anisotropy of polysilicon. Single crystal furnace mainly considers three factors: heat field + furnace design + crystal drawing process, good heat field and crystal drawing furnace can give a wide, stable and strong interference crystal pulling process window, so as to greatly increase the yield of crystal growth. The CMP polishing machine combines precise mechanical and chemical reactions to polish the silicon wafer. The flatness of the silicon wafer will affect the yield and performance of the subsequent chip production. The measuring equipment is used to control the quality of silicon wafer and optimize the process to improve the yield of silicon wafer. The measuring equipment is interspersed between the various silicon wafer manufacturing process, usually for each quality testing station, respectively, to detect the resistivity, conductive form and crystallization direction of the silicon wafer.

Large specification is the development trend of silicon wafer, the current 200mm and 300mm silicon wafer is still the mainstream

Under the influence of Moore's Law and cost, large specification silicon wafer is the mainstream trend of silicon wafer development. According to Moore's Law, due to the development of information technology, when the price is unchanged, the number of components on the integrated circuit will double about every 18-24 months, and the performance will double. At the same time, because the larger the silicon chip, the more chips loaded per unit chip, the processing and processing time of each chip decreases, which greatly improves the production efficiency of the equipment; Meanwhile, the edge wafer waste decreases and the production yield increases, thus reducing the unit manufacturing cost of the chip. So, driven by cost and Moore's Law, silicon wafers will go to large silicon wafers in the future. At present, the size of silicon wafer * can reach 450mm, but due to the influence of the application field and technology, it has not been successfully commercialized, so the output is difficult to reach the volume, and the mainstream silicon wafer is still dominated by 200mm and 300mm.

Different specifications of silicon wafers have different application fields, in which 200mm and 300mm specifications of silicon wafers have a wide range of applications. Silicon wafers of 200mm and below are more mature and widely used in the production of high-precision analog circuit, RF front-end chip, embedded memory, CMOS image sensor, high-voltage MOS and other products. The corresponding downstream of this kind of products is mainly automotive electronics, industrial electronics and other terminal markets. The 200mm silicon chips play a role in power devices, power managers, non-volatile memory, MEMS, display driver chips and fingerprint identification chips. These products are mainly used in mobile communications, automotive electronics, the Internet of Things and industrial electronics. The demand for 300mm silicon chips mainly comes from memory chips, universal processors, FPGA, ASIC, image processing chips, etc., and the corresponding downstream includes smart phones, computers, cloud computing, artificial intelligence, SSD and other high-end fields.

Semiconductor silicon wafer industry pattern

(1) Terminal application innovation brings a new round of business cycle improvement

The semiconductor industry shows obvious cyclical changes, and the industry prosperity is affected by the macro economy. From the perspective of the trend of data change, the sales scale of the semiconductor industry and GDP show a change trend in the same direction, and the industry cycle is about 3-5 years. In the analysis of the industrial chain before, the semiconductor industry is affected by the terminal application field demand, and GDP as a measure of national economic indicators, to a certain extent reflects the whole economic environment and consumer demand and cold degree, therefore, the change of GDP directly affect the demand in the field of terminal, indirectly affect the demand of the semiconductor industry. Based on cyclical changes and technological innovation in the terminal application field, the semiconductor industry is divided into five stages:

① 2000-2004 cellular phones and 3G communications were the main drivers of the semiconductor industry;

② PC 2004, consumer electronics and mobile communications from 2010;

③ In 2010-2014, smartphones replaced PC as the driving force of the industry;

④ 2014-2018 storage business demand increase to maintain the industry growth momentum;

⑤ In 2020,5G commercialization, IOT technology, AI and smart vehicles are expected to become new drivers in the future.

According to Granter data, the global semiconductor industry revenue growth shows a downward trend, and the industry revenue growth is expected to increase in the future. From 2017 to 2019, the sales growth rate of the semiconductor industry was 21.55%, 14.44% and 7.15%, respectively. In the past, the industry growth mainly depended on the expansion of applications such as smartphones, IOT and cloud technology. Growth continued to decline in 2019, in addition to the cyclical industry downturn and the sharp deterioration of trade friction between China and the United States, and the continued decline in smartphone demand. Regardless of the epidemic, according to the Granter2019 forecast, the revenue growth rate of the semiconductor industry from 2020 to 2022 will be-1.25%, 1.01% and 5.53%, respectively. The main driver is the continued strengthening of existing products, such as 5G communications, artificial intelligence, and technological innovation in the automotive and electronics industries, as well as a rebound in the semiconductor industry.

In 2020, the "black swan event" appeared, and countries introduced the policies of "home quarantine" and "travel ban", which had a huge impact on the global semiconductor industry chain. According to IDC 2020, there are four scenarios for global semiconductor industry revenue in 2020: from a worst 12% or more to * 6% or more, from a worst 9-12 months to a short 1-3 months. At present, due to the impact of the epidemic, the macroeconomic downward trend is obvious, and the end market demand will be affected. If the economy deteriorates further, the wave of unemployment occurs, which will have a negative impact on the upstream semiconductor industry of the industry. At the same time, the global supply chain is affected by the "pandemic policy", which also has a negative impact on the semiconductor industry.

The growth rate of semiconductor silicon wafer sales revenue showed an upward trend before 2018, and the revenue growth rate in 2019 declined sharply. From 2016 to 2017, revenue growth was 0.1%, 20.7% and 31.0%, respectively, and revenue growth plunged to-1.8% in 2019. The plunge in 2019 was mainly due to the sharp worsening trade friction between China and the United States and weak demand for smartphones.

(2) The semiconductor silicon wafer industry concentration degree is extremely high, and the market is in a monopoly pattern

At present, the market concentration of semiconductor wafer is extremely high. The market share of the top five semiconductor wafer manufacturers is as high as 92%, among which the market share of Japanese manufacturers is over 50%, and the industry market is in a monopoly pattern. The top five wafer manufacturers are Japan's Credit & Yue Chemical, Sumco, Siltronic, Taiwan's global wafer and South Korea's SK Siltron. Japanese manufacturers have a total market share of 52 percent, more than half of the semiconductor wafer market share. Japan has been in a high position in the semiconductor research and development and materials industry, with semiconductor giants including Toshiba, SONY and Renesas Electronics, as well as Sumco and Shinyue Chemical. Such an industrial pattern gives Japan more industrial chain advantages.

Semiconductor wafer industry has three main barriers: technical barriers, capital barriers and customer certification barriers.

Semiconductor silicon wafer industry is a technology-intensive industry, with the characteristics of high R & D investment, long r & D cycle and high R & D risk. With the continuous development of products in the terminal field, the requirements for semiconductor silicon wafers are also constantly improving. If the company cannot continue to invest in research and development, make breakthroughs in key technologies, or new product technologies cannot meet the target requirements, the company will face the widening gap with advanced companies and the risk of semiconductor silicon wafers to be eliminated by the market.

Because the semiconductor silicon wafer needs extremely high r & d investment and r & D cycle, it needs a long time to invest in the research and development to support the advanced talents, machinery and equipment. For advanced talents, there need to be high salaries to avoid the risk of brain drain.High-quality machinery and equipment are generally expensive. In addition to the risk of large capital investment, the company also faces the risk that the operating income cannot absorb the large fixed asset investment, leading to the decline in performance.

Semiconductor silicon wafers also face customer certification barriers. Semiconductor wafer is the core material of chip manufacturing. chip manufacturers have extremely high requirements for the quality of semiconductor wafer, so they will be very cautious about choosing semiconductor wafer manufacturers. According to industry practice, chip manufacturers will first certify semiconductor wafers, only the certified wafer manufacturers will be included in the supply chain, and the general minimum certification cycle can be 12-18 months, so once the certification, chip manufacturers will not easily replace suppliers.

(1) Japan's semiconductor industry glory: opportunities and challenges

The development of Japan's semiconductor industry can be divided into four stages: germination-rise-recession and transformation:

Gercent: "official production and learning" model helps the development of Japanese semiconductor industry. In 1972, Japanese companies were able to produce DRAM of 1K bits, while IBM's new system needed a product of 1000 times larger than 1K bits. Japanese companies once fell into despair. In order to increase the capacity from 1K to 1M, the Japanese government adopted the "official production and learning" model. The Japanese government has signed the VLSI Research Association, namely the Research Consortium, through the combination of five large Japanese semiconductor companies (Japan Electric, Toshiba, Hitachi, Fujitsu and Mitsubishi Electric), the Institute of Electronics, Japan Institute of Industrial Technology, and the Computer Research Institute. In terms of funds, the Japanese government gives strong support to the association. From 1976 to 1980, the total subsidy expenditure of the Japanese Trade Ministry reached 59.2 billion yen, of which 29.1 billion yen was used to support the VLSI Research Association, accounting for 49.2% of the total expenditure. The VLSI Research Association spent a total of 73.7 billion yen over the past four years, 39 percent of which was subsidized by the Ministry of Communications and Industry. Under the framework of the VLSI Association, in addition to the company's own laboratories, the Research Association established six joint laboratories based on each company, and each laboratory conducted research on different technologies. With the coordinated development of the VLSI Association, Japan has successfully developed many new technologies, paving the way for future competition.

Rise: DRAM moves towards Japan's semiconductor industry. In the 1980s, into the era of memory and mainframe, the rapid development of the Japanese automobile industry and the global large computer market, the demand for DRAM soared, the Japanese semiconductor industry seized this opportunity. Thanks to the development of VLSI Association, Japan has acquired technology in DRAM. At this time, Japanese enterprises have gained advantages in cost and quality by virtue of their mass production technology, and through the competitive strategy of low price promotion, they quickly penetrate the American market and the world market. In 1986, Japan's DRAM market share reached 70%, replacing the United States as a major supplier of DRAM.

Decline: the outbreak of the "US-Japan semiconductor war", the second industry transferred to South Korea and Taiwan, Japan's semiconductor industry gradually declined. By the 1990s, in the PC era, the advent of laptops had led to increased demand for semiconductor components. The United States has realized that Japan's semiconductor industry has surpassed the United States, and has seized the market share of American companies, and began to suppress Japan's semiconductor industry. However, under the dual pressure of insufficient investment and demand due to the stagnation of internal economic development and the external US breaking the trade protection, Japan gradually lost its advantage. By 2000, Japan's DRAM share had fallen to less than 10%, and Japanese enterprises retreated one after another. The direct reasons for Japan's backwardness are as follows:

1. During this period, Japan focused too much on high-quality DRAM and missed the opportunity of personal PC development. Japan focuses on the yield rate of products, compared with South Korea, which pays more attention to product throughput and production rate, such products have lower prices, to meet the demand of personal PC. In 1984, PC sales surpassed mainframe sales. Japan's semiconductor industry has been declining since the 1990s unable to cater to downstream demand.

2. Under the background of PC rise and policy support and new production, the rebels of South Korea and Taiwan seized the opportunity. In the United States busy against Japanese semiconductor industry, the South Korean government with the support of the United States to promote South Korea semiconductor industry take off: Taiwan to avoid semiconductor competition in the red sea, directly create Foundry foundry new mode of production, with its low labor cost and a large number of high-quality personnel, comply with the rapid development trend of consumer PC, replace most of the Japanese market share in the semiconductor industry.

Transformation: Semiconductor materials continue their former glory, in which semiconductor silicon wafers occupy an important market position. Although Japan's semiconductor chip share has shrunk, Japan's semiconductor wafer industry still occupies a large market share of the global semiconductor wafer industry (50% +). Semiconductor silicon wafer as the source of the semiconductor industry, Japan in the early development of chips, semiconductor silicon wafer also has great attention. In 1970, Japan produced about 6,000 tons, but in 1986 it increased to 60,000 tons, and changed from importer to exporter in 1979.In 1989, the Japanese government formulated the "Basic Plan for research and Development of Silicon Polymer Materials", and invested 16 billion yuan in 10 years from 1999 to establish the basic technology of silicone monomer and polymer synthesis and processing, which further expanded the semiconductor silicon wafer industry in Japan. Sumco first developed 300mm semiconductor silicon wafers in 2001, and its technology has been regarded as a model in the industry.

Conclusion: The "government, industry and learning" model launched by the Japanese government concentrates professional and competitive talents, and promotes mutual communication and cooperation between enterprises to tackle key problems, paving the way for the future competition. Later, Japan seized the demand for DRAM and successfully surpassed the United States as a global semiconductor producer in 1986. Since the 1990s, under the background of the suppression policy of the United States and Japan's bubble economy, Japan stubbornly to the mainframe DRAM technology and ignored the change of technology in the era of PC and mobile communication. It stuck to the IDM model and carried heavy burdens, tired of investment and innovation, and finally took the DRAM market by South Korea.

The development process of Japanese semiconductor industry is worth pondering:

1. In the semiconductor industry, it is not so much a competition between enterprises as a competition of national strength. Different from other market competition industries, the semiconductor industry itself has a strong periodicity and requires continuous R & D investment, which makes it difficult for commercial companies that operate purely by market rules to survive on their own. Therefore, the semiconductor industry needs a lot of policy support, coordinated development and trade protection. Japan relied on the "official industry and science" model and trade protection, which enabled its semiconductor industry to grow, and in 1986 surpassed the United States to become the global semiconductor industry. South Korea relies on a series of policy support, prompting the South Korean semiconductor industry to soar.

2. In the semiconductor industry, technological advantages are fleeting, and the enterprise's own research and development ability is an indispensable soul. At the end of the 1970s, Japan completed the "VLSI" project with the strength of the whole country and a huge amount of money, thus acquired the independent core technology, seized the opportunity brought by the development of the mainframe host, and surpassed it to become a global semiconductor production country. However, in the 1990s, the Japanese semiconductor industry missed the development opportunity of personal PC and mobile communication, and stuck in the development of DRAM. Finally, under the pressure of the United States, it was seized the market share by Korean enterprises. By 2000, the market share of DRAM in Japan was less than 10%.

(2) —— of Japan's semiconductor wafer industry under the threat of the United States

The current market share of semiconductor silicon wafers is mainly occupied by five top companies: Japan, Japan Sumco, South Korea Sk siltron, Germany siltronic and Taiwan Global wafer. But none of the top five wafer makers are American. The US, the giant in the global semiconductor industry, is so weak in silicon wafers. In fact, the silicon wafer industry was first created by the United States. Raytheon (Raytheon) and Monsanto (Monsanto) were the leaders in the industry, but in the end, the business was unable to keep up with the pace of The Times.

Although the Japanese semiconductor chip industry has been severely under the strong pressure of the United States, but Japan's perfect semiconductor industry chain, so that Japanese semiconductor silicon chip enterprises still insist on the semiconductor world stage. Shinsunet Chemical and Sumco, represent the development process of Japanese semiconductor silicon wafer industry to some extent.

Through the development process of these two enterprises, it is not difficult to see the development characteristics of silicon wafer manufacturing enterprises:

1. Merges and acquire related enterprises in the silicon wafer industry. The development of semiconductor wafer industry is accompanied by huge R & D and investment expenses, so the cost advantage generated by scale effect is particularly important. Only through mass production can manufacturers reduce fixed costs and improve profitability; secondly, through merger and acquisition, manufacturers can increase the market concentration and enhance the bargaining power of the industrial chain to maintain relatively stable profitability; finally, merger and merging enterprises with mature technologies can improve the production industry chain to some extent.

2. Give full play to the first-mover advantage of enterprises in the technology field. In addition to the breakthrough research on silicone, Japan has adopted a preemptive strategy for its research on 300mm silicon wafers. Japanese 300mm silicon wafer research began in 1994-1996, when 200mm silicon wafer still dominated, driven by cost, 300mm large silicon wafer is undoubtedly the development trend of the future. Japan pursues the development strategy of technology first, and organized by the electronic machinery committee EIAJ, electronic industry revitalization association JEIDA, new metal association JSNM, Japan semiconductor device association SEAJ and semiconductor industry research institute SIRIJ "large diameter silicon wafer working group", the group and the global silicon wafer summit organization us and European special working group, Asian working group. In 1999, Japan Sumco was the first to break the 300mm technology mark, and reached mass production in 2000. Japan 300mm silicon wafer technology development has been in the global *, especially in the mass production process process has become a model of the industry